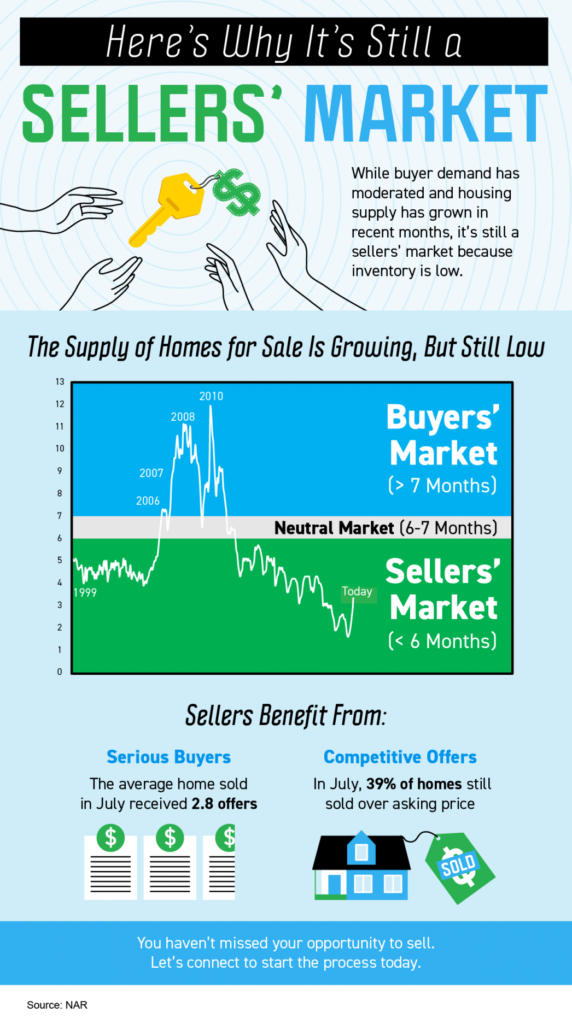

Some Highlights While buyer demand has moderated and housing supply has grown in recent months, it’s still a sellers’ market because inventory is low.The latest data shows sellers continue to benefit from serious buyers and competitive offers. In July, the average home received 2.8 offers and 39% sold over the asking price.You haven’t missed your opportunity to sell. Let’s connect...

One of the top stories in recent real estate headlines was the intensity and frequency of bidding wars. With so many buyers looking to purchase a home and so few of them available for sale, fiercely competitive bidding wars became the norm during the pandemic – and it drove home prices up. If you tried to buy a house over the past two years, you probably experienced this firsthand and may have...

One of the biggest questions people are asking right now is: what’s happening with home prices? There are headlines about ongoing price appreciation, but at the same time, some sellers are reducing the price of their homes. That can feel confusing and makes it more difficult to get a clear picture. Part of the challenge is that it can be hard to understand what experts are saying when the...

If you’re a homeowner or are planning to become one soon, you’re probably looking for clear information about today’s housing market. And if you’ve turned to the news or even just read headlines recently, you might feel like you’re left with more questions than answers. The best way to make sure you get what you need is to work with an expert. Why You Want To Lean on a Trusted...

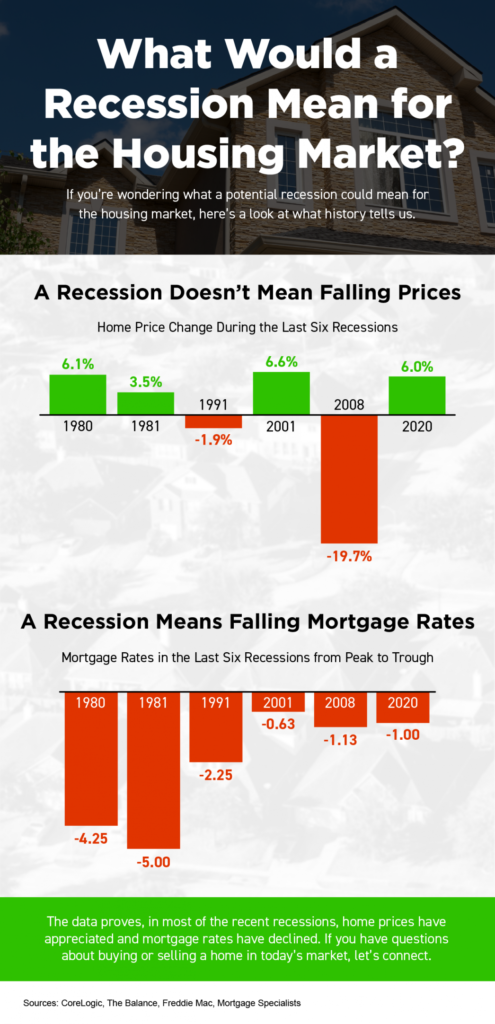

Some Highlights If you’re wondering what a potential recession could mean for the housing market, here’s what history tells us.In four of the last six recessions, home prices actually appreciated, only falling during the early 90s and the housing crash in 2008. Mortgage rates, though, declined during each of the previous recessions.If you have questions about buying or selling a home...

If you’re thinking about buying a home, you likely have a lot of factors on your mind. You’re weighing your own needs against higher mortgage rates, today’s home prices, and more to try to decide if you want to jump into the market. While some buyers may wait things out, there’s a reason serious buyers are making moves right now, and that’s the growing number of homes for sale. So far...

Whether or not you owned a home in 2008, you likely remember the housing crash that took place back then. And news about an economic slowdown happening today may bring all those concerns back to the surface. While those feelings are understandable, data can help reassure you the situation today is nothing like it was in 2008. One of the key reasons why the market won’t crash this time is the...

If you’re thinking about selling your house, you may have heard about the housing market slowing down in recent months. While it’s still a sellers’ market, the peak frenzy the market saw over the past two years has cooled some. If you’re asking yourself if you’ve missed your chance to sell your house and make a move, the good news is you haven’t – motivated buyers are still out there....

If you put off your home search at any point over the past two years, you may want to consider picking it back up based on today’s housing market conditions. Recent data shows the supply of homes for sale is increasing, giving buyers like you additional options. But it’s important to keep in mind that while inventory is improving, it’s still a sellers’ market. And that means you need to...

Some Highlights If you’re buying a home, here’s what you should know about your home inspection and why it’s so important.A home inspection is a crucial step in the homebuying process. It assesses the condition of the home you plan to purchase so you can avoid costly surprises down the road.Let’s connect so you have an expert on your side to guide you through the...